Betterment Review

March 10, 2019 | By Swift Budget | No Comments

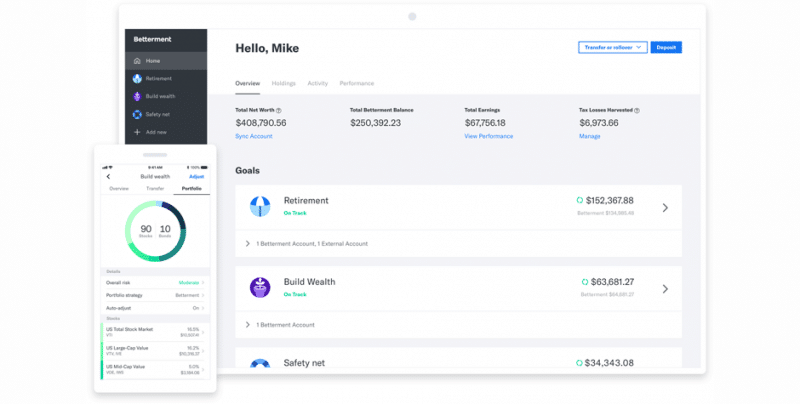

Betterment is an online financial advisor that manages around $15 billion for its clients and is one of the top financial companies for automated investing. Aside from being reputable, Betterment is easy to use and offers a hands-off option for building wealth. You can set up the app to do almost everything on automation, including depositing money and rebalancing your portfolio as needed. This Betterment review covers how the site works, what its main features are, and the pros and cons you’ll want to consider as you choose the investment company that’s right for you.

How Betterment Works

Betterment describes their process in four simple steps:

1. First, they ask for important information about you to help understand your personal financial goals

2. Then they’ll build you a personalized portfolio with a risk level and investment mix that suits each goal

3. Third, they help you decide on how much to invest

4. And finally, their cutting-edge technology manages your money efficiently

Betterment’s process is consumer-friendly and easy to use, even if you’re not a tech savvy person or a financial guru. The initial questionnaire asks you for your income, age, and investment goals. It will help you choose the best retirement accounts for your needs as well as shorter-term savings options. Using an intelligent algorithm, the site generates a portfolio that’s suitable for your needs. However, you still have the ability to make adjustments if you want to do so.

Betterment then makes a recommendation on what your initial deposit should be for each investment goal as well as how much your ongoing deposits should be. You can set up automatic deductions to help you hit your saving and investing goals.

The app’s automated management of your portfolio includes reinvesting dividends, tax loss harvesting, and rebalancing. Betterment has lower fees, and according their website, their approach helps you make 2.66% more per year on your money than the typical investor. Now we’ll take a look at some of its main features:

Investment Options

Betterment allows you to have multiple savings and retirement accounts in one place. You can see your retirement investments, emergency fund, and other wealth-building savings accounts in one place. It makes it easier for you to invest based on all of your varying goals. Based on what you’re investing for and your financial situation, the robo-advisor recommends how much you should save each month and helps you create a diversified portfolio. Some of the types of investments available at Betterment are ETFs, IRAs, lower-risk emergency funds, college savings plans, trusts, and more.

Tax Loss Harvesting

Betterment’s Tax Loss Harvesting can help you offset other gains and income. When an investment loses value, they can automatically sell it and move into a similar investment. This will harvest the loss saving you money on your taxes while still providing a similar rate of return. According to Betterment this can add an estimated 0.77% per year to your after-tax returns.

Portfolio Rebalancing

Betterment offers automatic portfolio rebalancing when an asset class surpasses 2–3% of its target allocation. It also rebalances your portfolio when cash flows in or out via withdrawals, contributions, and dividends. The app checks on a daily basis if your portfolio needs rebalancing.

Fees

Betterment charges a 0.25% annual fee on “digital” accounts and a 0.40% annual fee on “premium” accounts. You need a $100,000 minimum balance for a premium account and a $0 minimum balance for a digital account. Betterment doesn’t charge fees for buying or selling securities. Withdrawing and depositing money is also free. Betterment’s advice packages start at $149. These packages include topics such as getting started, marriage planning, college planning, financial checkup, and retirement planning. Fees aren’t charged on accounts that have no balance, so you won’t lose money if your account is sitting at $0.

Advice

The site also provides ongoing advice to help you successfully grow and protect your money. Financial experts guide the technology that manages your investments. Betterment consults with financial experts outside of the company for additional advice on allocation, portfolio construction, and approaches to continue offering an effective service for clients.

Regulation

Betterment is regulated by the SEC (Securities and Exchange Commission), and it’s also a member of FINRA (Financial Industry Regulatory Authority) and SIPC (Securities Investor Protection Corporation). Most securities through the app are protected up to $500,000.

Now let’s look at some pros and cons:

Pros

You don’t need a minimum balance

Cutting-edge technology creates portfolios customized to your personal goals

Automatic deductions help you stay on track

Good for hands-off and beginner investors

Hands-on investors have the ability to create their own portfolios

Access to financial experts with a premium account

Rollovers are available at no extra cost

Cons

Smart Saver accounts are not FDIC-insured

Fees are low, but they are still higher than if you invested in index funds on your own

Conclusion

Betterment is an automated investment company that can help you grow your wealth and save for important life events like college, marriage, purchasing a home, and retirement. Although it’s easy for beginner investors, the app offers features and flexibility for those who are knowledgeable about investing and want to be more involved in their investments. Premium account owners can also communicate with a licensed financial expert free for additional advice on reaching their investment goals.

If you sign up through our affiliate link you could get up to 1 year managed free. It doesn’t cost you anything, and it helps us out a ton. Thanks for your support!